Procter & Gamble is quietly bringing a new luxury diaper brand from China to U.S. store shelves as its flagship Pampers and budget Luvs brands lose traction in a crowded and increasingly competitive diaper market.

The Cincinnati-based company, best known for household staples like Tide detergent and Dawn dish soap, is selling its aloe-infused “bumbum” diapers at Target. It’s an unusual move for P&G, which typically makes its U.S. products domestically.

Target first announced earlier this year that it would roll out bumbum as part of a revamp of its baby section but didn’t reveal the maker. P&G later confirmed the brand, calling it part of a broader strategy to offer “superior products” alongside Pampers and Luvs. Neither P&G nor Target addressed questions about the diapers being made in China or how tariffs might affect prices.

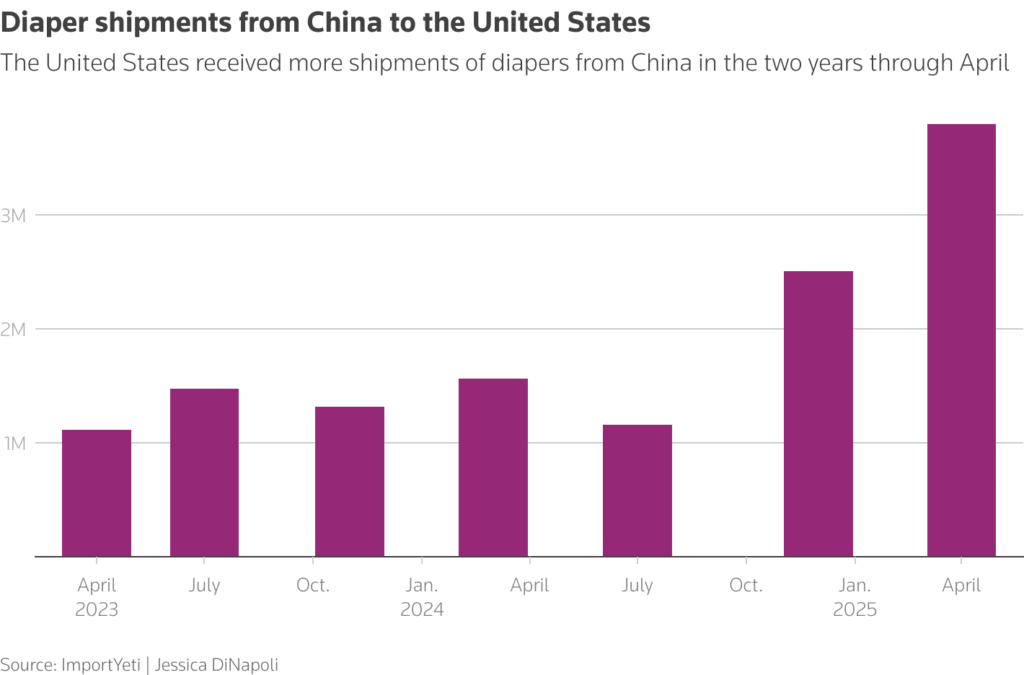

The launch reflects a larger shift. Imports of Chinese-made diapers have surged, tripling in just two years, as American manufacturers face higher costs at home. Industry experts say today’s Chinese diapers are virtually indistinguishable in quality from U.S.-made ones, while government subsidies and lower labor costs allow them to sell at far cheaper prices.

At Target, Pampers Pure diapers cost around 37 cents apiece for a size 2, compared with 28 cents for Millie Moon, a Chinese-made competitor. Bumbum undercuts Millie Moon by a penny.

Tariffs are complicating matters. P&G executives have acknowledged raising prices to offset the levies, even as shoppers tighten their budgets. Other baby essentials like strollers and car seats, many of which are made in China, have also gotten more expensive.

That pressure is showing up in sales. Pampers still leads the $5.4 billion U.S. diaper market, but its share slipped to 32.3% in 2024 from 32.5% two years earlier, according to Euromonitor. Luvs has fallen harder, dropping from 9% in 2019 to just 6.9%.

Some see bumbum as a test run. Industry consultant Pricie Hanna says P&G may be trialing features that could later appear in Pampers, similar to how rival Kimberly-Clark leaned on its China-based teams to redesign Huggies.

Competition is fierce as birth rates decline. Parents are buying fewer diapers overall, forcing companies to win customers with premium features they can charge more for.

Chinese-made brands are gaining traction fast. Millie Moon and Rascals, both owned by Hong Kong-based Zuru Edge, have posted triple-digit growth since 2020. At Walmart, Rascals diapers sell for about 21 cents each, less than a third of Pampers Pure. Together, the two brands now hold 3.5% of the U.S. market, Bain Consulting estimates, though the real number is likely higher once e-commerce sales are counted.

Other players are cutting costs to stay competitive. Parasol, a China-made diaper sold at Target and Amazon, now ships in plain brown boxes instead of decorated packaging to save money. “It wouldn’t kill the market to raise prices, but we would definitely lose some customers,” said founder Jessica Hung.

For now, consumers seem willing to pay up for softness and quality. But with tariffs pushing prices higher and cheaper imports flooding shelves, even giants like P&G are being forced to rethink how they sell diapers in America.